Yelp Snags an Upgrade from Goldman Sachs

Yelp (NASDAQ: YELP) received an upgrade from Goldman Sachs on Monday, with the investment bank raising its price target on the stock to $45 from $35. Goldman analyst Eric Sheridan said that he sees Yelp benefiting from a number of tailwinds, including the continued growth of online food ordering and the rebound in the travel industry.

Why Yelp was upgraded

Sheridan upgraded Yelp on the belief that the company is well-positioned to benefit from a number of tailwinds. These tailwinds include:

- The continued growth of online food ordering: Sheridan said that he expects the online food ordering market to continue to grow in the coming years, and he believes that Yelp is well-positioned to capitalize on this growth. Yelp generates a significant amount of revenue from its food delivery business, and Sheridan believes that this business will continue to grow in the coming years.

- The rebound in the travel industry: Sheridan also said that he expects the travel industry to rebound in the coming quarters, and he believes that Yelp will benefit from this rebound. Yelp generates a significant amount of revenue from its local guide business, and Sheridan believes that this business will benefit from the increased travel activity.

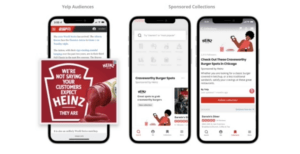

- The launch of Yelp’s new advertising products: Yelp recently launched a number of new advertising products, and Sheridan believes that these products will help to drive revenue growth in the coming quarters. Yelp’s new advertising products include a new local deals product and a new product that allows businesses to target customers who are near their location.

Revenue growth is expected in the second half of 2023.

Sheridan said that he expects Yelp’s revenue to grow by 10% in the second half of 2023. This growth will be driven by the factors mentioned above as well as the continued growth of Yelp’s advertising business.

Here are some of the reasons why Goldman Sachs upgraded Yelp:

- The company’s advertising business is growing rapidly.

- Yelp is expanding its reach into new markets.

- Yelp is offering more targeted advertising options to businesses.

- Yelp is launching new product offerings, such as Yelp Reservations.

Here are some of the challenges that Yelp faces:

- The company is facing increasing competition from other online review platforms, such as Google Maps and TripAdvisor.

- Yelp’s advertising business is still relatively small, and it is not clear how much growth the company can achieve in this area.

- Yelp’s stock price is volatile, and it has been under pressure in recent months.

Overall, Goldman Sachs’ upgrade on Yelp is a positive sign for the company. The firm’s analyst sees revenue growth as Yelp expands its advertising business, and he believes that the company’s new product offerings will help to drive growth in its restaurant business. However, Yelp still faces some challenges, such as increasing competition and a volatile stock price.

Conclusion

The upgrade from Goldman Sachs is a positive sign for Yelp, and it suggests that analysts are bullish on the company’s future. Yelp is well-positioned to benefit from a number of tailwinds, and Sheridan’s revenue growth forecast suggests that the company is on track to deliver strong results in the coming quarters.

Additional context:

- Yelp is a local commerce platform that connects people with local businesses. The company’s website and mobile app allow users to search for businesses, read reviews, and book appointments.

- Yelp generates revenue from advertising, lead generation, and transaction fees. The company’s advertising business is its largest source of revenue, and it generates revenue from both local businesses and national brands.

- Yelp’s stock price has been on a downward trend in recent months, but it has started to rebound in recent weeks. The stock is currently trading at around $38 per share.